Channel jamming attacks

Channel jamming attacks are Denial of Service (DoS) attacks where an attacker can prevent a series of channels up to 20 hops away from being able to use part or all of their funds for a prolonged period of time.

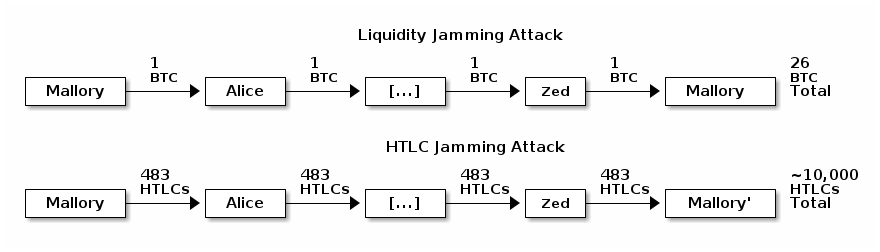

An LN node can route a payment to itself across a path of 20 or more hops. This creates two possible avenues for channel jamming attacks:

-

● Liquidity jamming attack (originally called the loop attack in 2015) is where an attacker with

xamount of money (e.g. 1 BTC) sends it to themselves across 20 other channels but delays either settling or rejecting the payment, temporarily locking up a total of20xfunds belonging to other users (e.g. 20 BTC). After several hours of locking other users’ money, the attacker can cancel the payment and receive a complete refund on their fees, making the attack essentially free. -

● HTLC jamming attack is where an attacker sends 483 small payments (HTLCs) through the series of 20 channels, where 483 is the maximum number of pending payments a channel may contain. In this case, an attacker with two channels, each with 483 slots, can jam over 10,000 honest HTLC slots—again without paying any fees.

A variety of possible solutions have been discussed, including forward upfront fees paid from the spender to each node along the path, backwards upfront fees paid from each payment hop to the previous hop, a combination of both forward and backwards fees, nested incremental routing, and fidelity bonds. As of April 2021, no solution has gained widespread support and developers continue to discuss the issue.

Primary code and documentation

Optech newsletter and website mentions

2022

- 2022 year-in-review: channel jamming

- CircuitBreaker add-on software to partly mitigate jamming attacks without protocol changes

- Reputation credentials proposal to mitigate LN jamming attacks

- Paper suggesting solutions to jamming attacks based on local reputation and upfront fees

- Guide to channel jamming attacks and proposed solutions

2021

- 2021 year-in-review: channel jamming

- Summary of LN developer conference, including discussion of channel jamming attacks

- Making jamming attacks more expensive by lowering the cost of probing

- Renewed discussion about bidirectional upfront LN fees

2020

- 2020 year-in-review: LN channel jamming attacks

- Fidelity bonds to prevent channel jamming attacks

- Bi-directional upfront fees to mitigate jamming attacks

- More upfront fees discussion

- Trusted upfront fees to mitigate jamming attacks

- Incremental routing as an alternative to upfront fees

- Eclair #1539 implements a simple measure to reduce channel jamming attacks

- Reverse upfront fees to mitigate jamming

2019

Previous Topic:

Channel factories

Next Topic:

Coin selection